2020 went down into history as the year where crypto gained the institutional momentum it had been waiting for. And now, everybody LOVES bitcoin 💖. Well, almost everyone, anyway. Although many skeptics remain, it is fascinating how the times have changed. Suddenly, bitcoin is in the headlines of mainstream publications, daily. It was on Monday’s front page of the FT, always the crypto critic. It is included in daily global market roundups. And large investment banks are starting to call out price targets. This is just the first inning, but 2021 is off to an exciting start.

Bring. It. On.

In this issue:

Top story: OCC announcement

The times have changed

The rush for crypto market data

Interesting perspectives on 2021

By the numbers

And: food for thought top picks, the big picture, and quote of the week.

Top Story

New OCC Guidance: Banks Can Conduct Payments Using Stablecoins

US banks can now use public blockchains and dollar stablecoins as a settlement infrastructure in the US financial system. The OCC said blockchain-based stablecoins “may enhance the efficiency, effectiveness, and stability of payments activities.”

The interpretive letter establishes that banks can treat public chains as infrastructure similar to SWIFT, ACH and FedWire, and stablecoins like USDC as electronic stored value.

Analysts said the move may encourage banks to develop stablecoins for faster payments. David Grider of Fundstrat sees the development as long-term positive for the crypto industry, though with winners and losers.

The statement follows a Dec 23 warning from the US Treasury and other agencies that stablecoin issuers need to tighten protections against money laundering.

Trend follower: connecting the dots

The times have changed

Several media outlets including Bloomberg ran stories about JPMorgan seeing a $146,000+ long term price target for bitcoin. Analyst Nikolaos Panigirtzoglou has been writing regularly about bitcoin in his “Flows & Liquidity” report. He set the long term target on the basis of bitcoin winning the competition with gold over time. However, it is “unrealistic to expect that the allocations to bitcoin by institutional investors will match those of gold without a convergence in volatilities,” which “is unlikely to happen quickly” and is a multi-year process.

Legendary investor Bill Miller dedicated a section (22%) of his quarterly market letter to bitcoin. He summarized the value proposition of bitcoin damn well in 221 words. You are best off to read it for yourself. If not, read his quote at the end of this newsletter 😂

Ross Stevens, founder and CEO of Stone Ridge, dedicated his entire 2020 shareholder letter to bitcoin. He explores the soundness of money, or lack thereof, as one of our “most obvious, most important realities…hardest to see…hidden in plain sight all around us.” He concludes that “having a non-zero allocation to Bitcoin-denominated life insurance, and annuities, may represent our most potent defense against the malevolent consequences of benevolent, well-intentioned past, current, and future central bank activity.” Stone Ridge is the parent company of crypto prime broker NYDIG and holder of $400M+ in bitcoin.

Joe Weisenthal featured bitcoin in “here’s what Joe's interested in this morning” two days in a row. On Monday he labeled bitcoin as “the first true religion of the 21st century.” On Tuesday he elaborated arguing that “it is a big deal and key to understanding how Bitcoin works.” “Gold and silver eventually became money because of this perceived mystical link that made it distinct from other worldly commodities.”

Luckily, skeptics remain. Laurent & Gilbert come down hard on bitcoin and SkyBridge in an opinion post for Bloomberg “Bitcoin's biggest fans are hedge fund baby boomers.” I don’t agree with most of what they say, but it is a different perspective and a reminder that crypto as an asset class is still early and has a long way to go.

The rush for crypto market data

We hadn't had a chance to blink our eyes yet and acquisition no.1 is in the books. As expected, market data is off to a strong start. And, another example of how the times have changed with the WSJ breaking the news that Coindesk bought TradeBlock. That would not have happened a year ago.

CoinDesk Buys TradeBlock, Joining Rush for Bitcoin Analytics

The terms of the deal are undisclosed. Coindesk and TradeBlock are both part of the DCG umbrella, as is Grayscale which uses TradeBlock’s flagship product, the XBX bitcoin price index as its reference rate. TradeBlock previously raised $53M in venture funding and was founded by the Schvey brothers, now running blockchain enterprise company Axoni.

TradeBlock originally came to market as an early crypto OMS. The company later pivoted to data, building on top of XBX and related offerings.

In a press release, Coindesk said to deliver “the industry standard for the price of bitcoin and for other cryptocurrency reference rates and indexes, bringing transparency and data integrity to Wall Street and Main Street investors.” It also drew a comparison to the role Bloomberg plays in traditional markets. Coindesk is planning to invest in TradeBlock’s OMS and enterprise trading tools. Coindesk’s website gets 5M monthly views. It will be interesting to see how they will commercialize this acquisition.

As we discussed before, one of the big challenges in crypto is determining what bitcoin is worth at any point in time. Reference rates like TradeBlock’s XBX are an important feature in traditional capital markets. With crypto gaining institutional momentum, market data and indices are becoming more important to the industry. As the likes of FTSE and S&P already realized.

2020 saw other prominent crypto news and research services launching data products too. Coindesk competitor The Block launched a data dashboard last October. Delphi Digital launched Delphi Radar powered by The Tie late December. And Messari, a crypto data and research provider, recently launched its new dashboard which has a Bloomberg type look and feel to it.

Cointelegraph ran a story “How crypto data aggregators fight fake exchange volumes”. Although crypto market data has improved since Bitwise did its fake volume analysis in 2019, the article highlights that challenges remain. This further illustrates the need for high quality market data.

Amber Data, a provider of digital asset data solutions for financial institutions launched a comprehensive crypto derivatives data API.

Interesting perspectives on 2021

Fred Wilson: Governments will keep printing money and tax and regulate innovative new companies to protect old and dying companies. This will lead investors to continue to allocate capital to new forms of money (crypto) and new ways of creating and financing innovation (decentralized projects and organizations). The idea of financing and executing innovation inside of a global DAOs is such a powerful idea and one whose time has come.

Jump Capital’s Peter Johnson: corporate treasurers ignore bitcoin as corporate treasurers’ primary goal is short-term cash management, not long-term strategic investing. Peter does expect at least one Central Bank to buy bitcoin as a strategic store of value against depreciating fiat currencies. Su Zhu of Three Arrows Capital agrees.

Nic Carter: Bitcoin may bifurcate into lit and dark markets on the back of the implementation of FATF’s travel rule recommendations. “In many ways, this would mirror the way that financial gold operates.”

Meltem Demirors: digital art and online creator economies are going to explode and tokenization is going to turn creative economics upside down.

Alexander Svanevik (Nansen): 2021 is the year DeFi meets fintech. Crypto companies will build bridges from DeFi to legacy finance via fiat integrations. And from the other side, companies like Revolut and Paypal will start dabbling with DeFi savings products and stablecoins.

Qiao Wang: As CBDCs and stablecoins around the world begin to flourish, FX will be the most under-discussed yet the most contested battleground in DeFi.

By the numbers

$1T+: the current aggregated market cap of crypto assets

6,000+: the number of comments FinCEN received on its proposed rule change

$460M: the rumored amount Nexon is bidding for Korean exchange Bithumb

$8.2M: the amount of crypto artwork sold in December

$535,000: the price of BTC if it achieves the same market cap as gold

Food for thought top picks

Highlights of SkyBridge’s investor deck

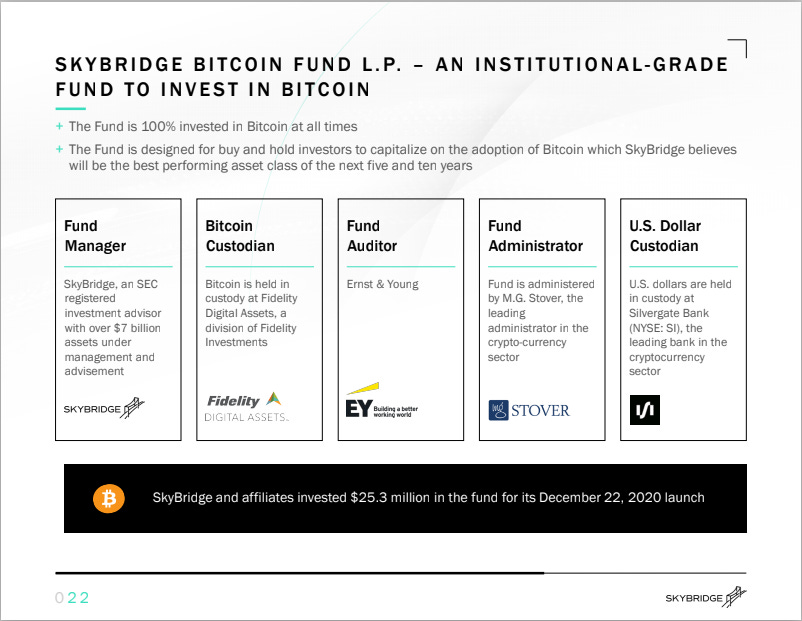

SkyBridge launched its Bitcoin fund this week with $310M in AUM invested from its $3B flagship fund. Their deck is worth a flip through. Some highlights below.

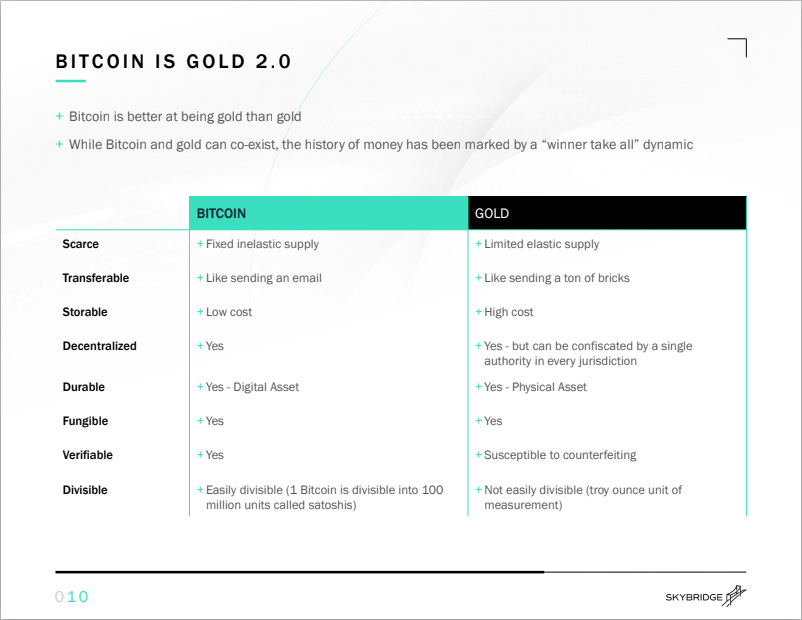

Bitcoin is better at being gold than gold

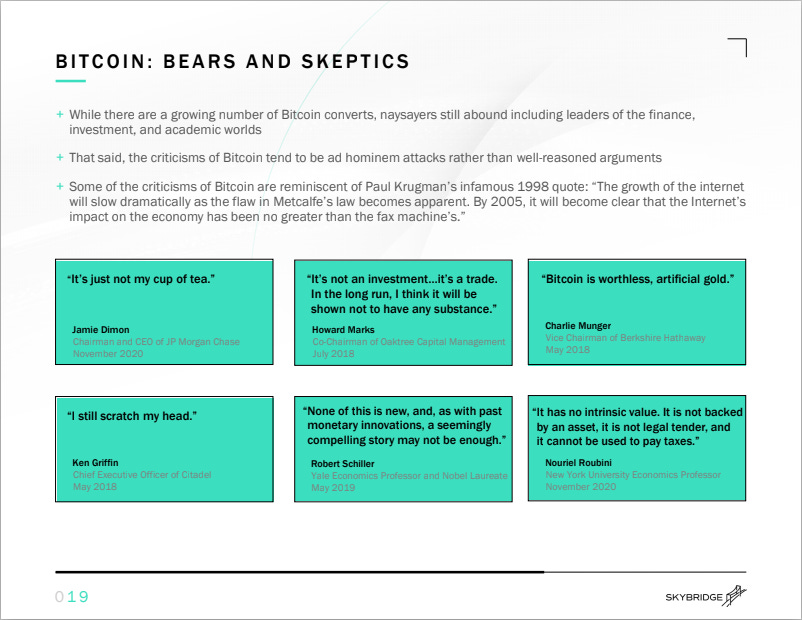

Criticisms on bitcoin tend to be “ad hominem attacks” rather than well-reasoned arguments

SkyBridge Bitcoin Fund service providers

Messari on Metaverses (digital worlds)

Messari wrote an interesting piece on “Metaverses” — virtual worlds. To date, investors have spent nearly $55M on metaverse digital land and in-game items out of $150M in total NFT sales volume. Metaverses are made up of pieces of digital land that users can develop in whatever way they see fit. The phenomenon is an extension of massively multiplayer online games (World of Warcraft) and social simulation games (Minecraft). Since humans are spending years of their lives in virtual worlds, they will naturally gravitate towards the ecosystems that reward contributions like Metaverses. Metaverses values are currently driven by speculation.

ShapeShift integrates DEXes

Non-custodial exchange ShapeShift is now routing orders through DEXs to get rid of KYC regulations. Founder Eric Vorhees said “ShapeShift’s original model was designed to protect users, providing instant liquidity without requiring them to trust a custodian. We had to be the counterparty – the market maker – to provide that service at scale. The decentralized protocols are now providing a superior service, so we’re embracing this evolution and helping our customers easily connect with them.” ShapeShift receives a portion of trading fees that each DEX charges in return for directing traffic.

The Big Picture

It may be coincidence, but I picked up on a number of articles this week that have one common denominator: the trends they are describing have their origin in QE.

People are concerned about America (FT)

Even if they do not trigger high inflation, QE will come with steep price tags. The Fed’s inescapable bias towards asset owners has combined with the financial sector’s preference for size to produce a very skewed recovery. The majority of people are suffering amid a Great Gatsby-style boom at the top. The opportunity is for the US government to borrow long at near zero rates and invest it in productive capacity. QE minus fiscal action equals populism.

Double stock-market bubble brings toil and (perhaps) trouble (WSJ)

Investment choices previously viewed as overpriced showed big gains in 2020. Can they prove doubters wrong again? Or are we in a new era of wild speculation driven by cheap money that must inevitably come to an end? Regardless, the stunning performance of so many bubble stocks this past year shows that even if the latter turns out to be right eventually, there is plenty of scope to be horribly wrong in the meantime.

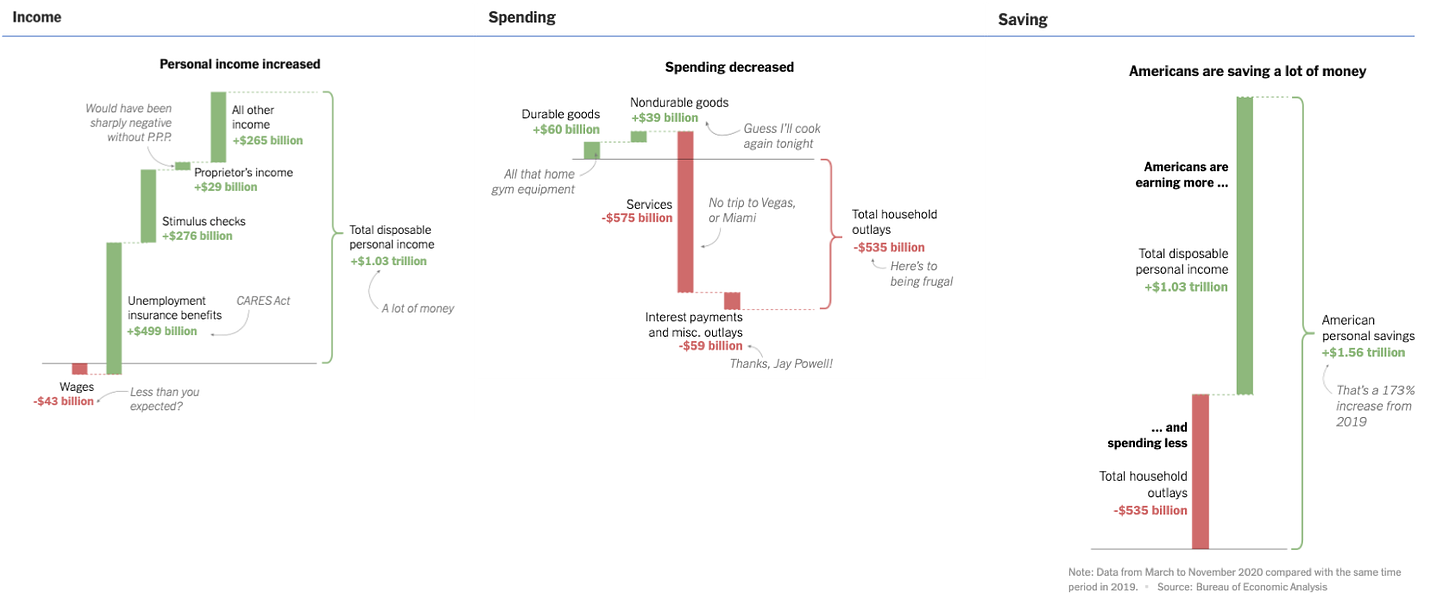

Why Markets Boomed in a Year of Human Misery (NYT)

The NYT is arguing that “It wasn’t just the Fed or the stimulus.” Rather, the rise in savings among the people who have avoided major economic damage from the pandemic is creating a tide lifting the values of nearly all financial assets. The charts below tell the story (revert to the article for sharper images).

Quote of the week

Bill Miller in his 4Q 2020 Market Letter

Warren Buffett famously called bitcoin “rat poison.” He may well be right. Bitcoin could be rat poison, and the rat could be cash.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.