Happy Thanksgiving everyone, may the turkey be with you. In case you need a break from family, football, or stuffing your face, here is an analysis of the interesting stuff in crypto this week.

In this issue:

Crypto market data quality, set to improve?

On BTC’s rise 🚀🚀🚀

Institutions are going bitcoin

And: CBDC highlights, food for thought top picks, four bitcoin charts, the big picture, quote of the week (challenging the headlines).

Top story

Ethereum 2.0 (Eth2) deposit contract secures enough funds to launch, date set for Dec 1. The deposit contract hit the required target for triggering “Phase 0” with only hours to spare.

Ethereum is about to take the first step in its transition from proof-of-work to proof-of-stake. On Dec 1 Phase 0 of Eth2 is launching, after years of research and development. It is expected to be a years-long process.

Eth2 is a major network upgrade that will increase scalability, security, and energy efficiency without compromising on accessibility or decentralization.

The launch of Eth2 will activate a parallel proof-of-stake blockchain dubbed “the beacon chain” to run in parallel alongside the existing network. The beacon chain activation is the first of four phases of the Eth2 migration, which begins with the onboarding of validators and eventually leads to the full transition of all users and dApps to the new network. The Block lays out the phases.

Trend Follower: Connecting the Dots

Crypto market data quality, set to improve?

Market data remains a tough nut to crack in crypto. Exchanges have come a long way in recent years but still have some ways to go in terms of the sophistication of regulated exchanges in traditional asset classes. Market data is one such area. There are no market-wide standards and several exchanges are suspected to inflate volumes. Exchanges also haven’t figured out yet how to monetize their data and most have no standard redistribution agreements in place. All of this makes it hard for aggregators and index providers to put together high quality offerings.

At the same time, high quality, reliable market data is key for traditional institutional investors that are moving into the space. It is good to see some activity in recent weeks including from traditional providers which I take as a sign that the above is improving.

Fidelity Investments is piloting a new crypto data platform, Sherlock Analytics, per Boston Business Journal. “The crypto data market is currently fragmented, with dozens of providers each offering different categories of data with varying quality. Institutional investors have told us that this lack of a mature crypto data industry is one of the largest barriers impeding broader adoption of digital assets,” a Fidelity spokesperson said.

Lukka partners with IHS Markit to plug crypto data into Wall Street. Lukka CEO Robert Materazzi commented "The traditional global custodians and fund admins have all been working on something with crypto and blockchain for some time. Direct conversations we are having with big logos shows [crypto] is finally touching their businesses instead of the innovation labs."

MicroStrategy CEO Michael Saylor told investors in a conference call that the firm is eager to “leverage” its business intelligence experience in the bitcoin data space. “There’s an entire exploding universe of intelligence opportunities all wrapped around this kind of unique bitcoin intelligence coming off the blockchain,” he said. “And we’ll explore it all.” Saylor had called crypto market data “garbage” in an October interview.

FTSE Russell introduced the FTSE DAR Reference Price for the digital asset market. FTSE Russell, owned by the London Stock Exchange, and Digital Asset Research (DAR) collaborated to help address current investor challenges in the digital asset space including limited oversight, inconsistent market practices and unreliable issuer pricing.

A practical problem that illustrates the importance of the above: what is bitcoin's actual all-time high price? When the Dow Jones or the S&P 500 hit a record, it is clear. There is just one number. Not so much for bitcoin. With high quality market data, good reference price indices can be constructed. Over time, a winner will emerge that will become the industry standard to be used as a fixing index for other indices and financial products. We have seen this in the FX space with the WM/Reuters benchmark series.

On BTC’s rise 🚀🚀🚀

Of course there are plenty of opinions on why BTC has been flying. Here is a selection of thoughts on what is underpinning this rally.

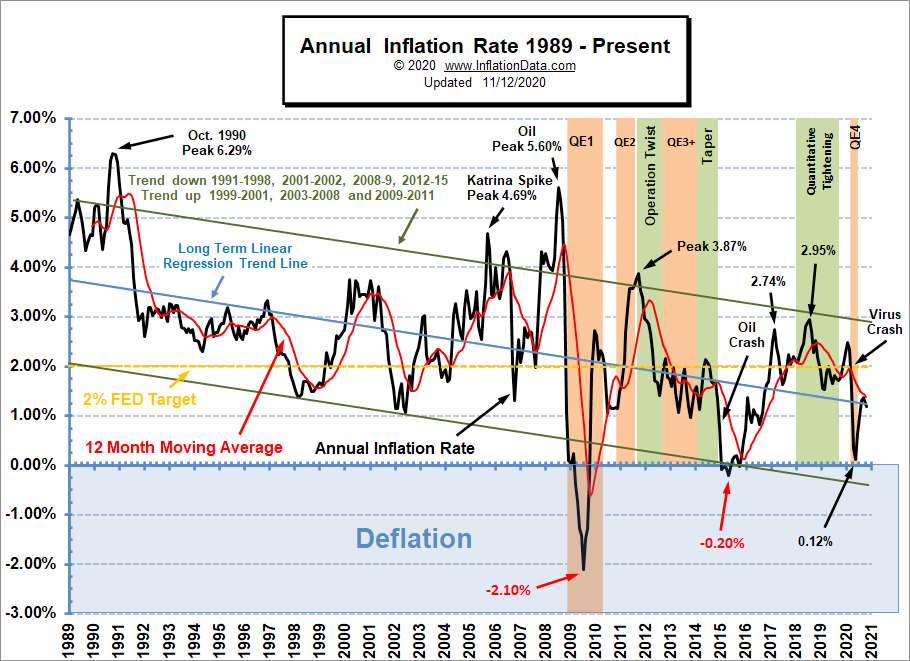

First, there is the well-understood argument of the inflation hedge. “The level of fiscal spending and money creation has likely driven many investors to Bitcoin, as it may serve as a safe haven as the value of fiat currencies like the US dollar comes into question.”

Hedge funds, not hipsters, may be powering bitcoin’s second big rally. There is now “a greater urgency by institutional investors to not miss out — to invest some of their assets in bitcoin, because this time looks different.” With hedge funds and other professionals also buying, supply will become even more constrained, Dan Morehead told the WSJ. “The only way supply and demand equilibrates is at a higher price.”

Bitcoin’s accessibility through platforms like Paypal, Robinhood, and Square.

According to Reuters bitcoin is a “risk-on” trade with liquidity from emerging currencies and junk bonds flowing to stocks and bitcoin.

Ongoing institutional adoption by the likes of Paypal, Square’s Treasury, JPMorgan (banking crypto exchanges). Investors are also following the lead of the likes of Paul Tudor Jones, RenTec, and Stan Druckenmiller.

Brian Kelly, a long term bitcoin bull, sees signs of a near term top for three reasons:

Speculative coins are surging: “Bitcoin is subject to FOMO more than anything else. We are starting to see speculative coins go up 30% to 40% a day. Those are the types of things that happen at short to medium-term tops.”

Large implied address growth: “When I look at the address growth, the market is pricing in about 25% address growth over the next 30 days. Whenever you get that big of an address growth implied, that is a caution sign.”

Futures funding rates are high: “We are starting to see retail come into this market and you’re starting to see the interest rates that it charges on margin going much higher.”

“If you are buying bitcoin at $19K, you need to be prepared that it drops to $12K before it goes to $50K”. As of this morning he seems right about that near term top/pull-back.

Institutions are going bitcoin

Australia’s Pendal Group with billions in AUM starts investing in BTC futures.

Japanese financial giant SBI debuts BTC lending service.

BlackRock’s CIO says bitcoin could replace gold to a large extent.

SoftBank’s CEO meanwhile sold his Bitcoin for a heavy loss (in 2018): it was 'distracting'.

CBDC Highlights

China's Xi calls for G20 to adopt 'open and accommodating attitude' on CBDCs.

Rumors of second digital yuan lottery in Suzhou.

Goldman Sachs expects digital yuan to reach 1B users within 10 years.

New papers and analyses:

ECB working paper: CBDC in an open economy.

IMF outlines legal issues for CBDCs.

Monetizing Privacy with CBDCs (NY Fed).

Food for thought top picks

#1 Perspectives on Crypto Asset Indexation and On-Chain Asset Management. A perspective from Danny Masters, Chairman of CoinShares. Indexation was the gateway for institutional investors to enter commodity trading in the early 2000s. Indexation in crypto is tough because cryptoassets are highly correlated offering little protection in a downturn. CoinShares has created an index that gets around that by rebalancing between a basket of crypto assets and gold. It is an investable index that can be replicated purely digitally, which is unique.

Two reasons why the above is important: (1) CoinShares believes the next wind of change in the asset management industry (at least for the younger generation) will be a move to on-chain asset management, and (2) as asset classes mature, and investors think more about exposure to the class rather than picking winners within it, indexation becomes more prevalent.

#2 The Vampire Diaries – A SushiSwap Case Study. Conclusion: “It is fascinating to observe in real time how new competitive dynamics play out in the world of DeFi. Due to the transparency of open-sourced code, extremely low barriers to entry exist for vampiric forks. Whether they can remain competitive vs. incumbents is a separate matter altogether.”

This reminds me of Multicoin’s fireside chat with Micky Malka featured here a few weeks back. Micky compared forks to banks copying each other on everything in the “real world”. He commented that most financial products are commoditized and that it comes down to having a trusted brand. In the case of DeFi not enough trust has been built yet and it is also a bit of a catch-22 because of its decentralized nature.

#3 Sports has a Gen Z problem. The pandemic may accelerate it. The Washington Post describes how Gen Z eschews traditional television-viewing and instead subscribes to digital habits that make grooming a new generation of sports fans a challenge. Failing to hook young people might not devastate today’s bottom line, but it threatens to muddle the future of every league, every team, and every sport.

This plays nicely into Jeff Dorman’s piece about ESPN and tokens that was featured here last week. As well as some of the other sports and fan engagement themes that seem to do well in crypto. Sorare announced a few weeks back that it signed with Bayern Munich, one of Europe’s top soccer clubs.

It all comes down to the idea of non-crypto businesses leveraging the concept of a token in new and creative ways to bring new customer experiences and align users behind any success. I am hoping to publish an article with more thoughts around this in the coming week. Stay tuned.

Four Bitcoin Charts

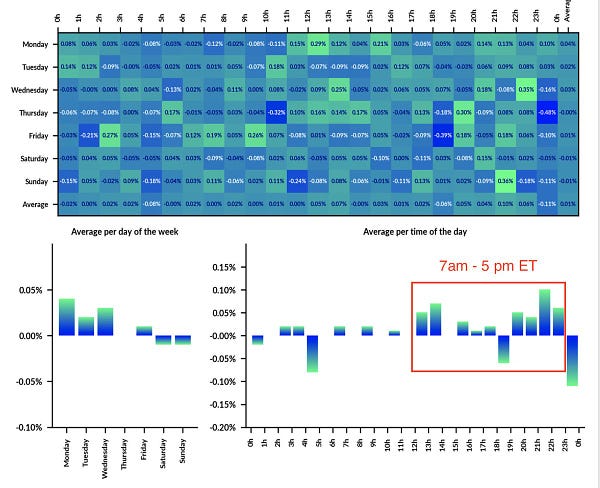

#1 Nine to Five: The bulk of the BTC rally is attributable to buyers that only operate M-F 9-5 Western business hours. Nic Carter is looking at BTC seasonality data. “In the last 360d, BTC returns have mainly come during weekdays in US/EU trading hours. Mondays are big due to pent up demand from the weekend.” Sounds like institutions to me...

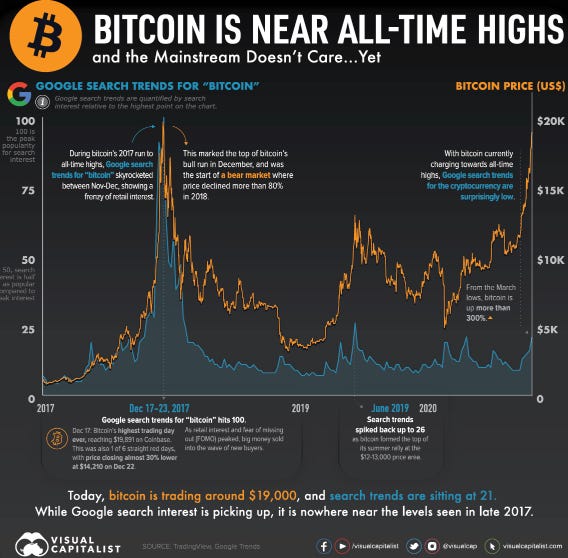

#2 The Visual Capitalist seems to conclude the same: Bitcoin is closing in on all-time highs...and the mainstream doesn’t care...yet.

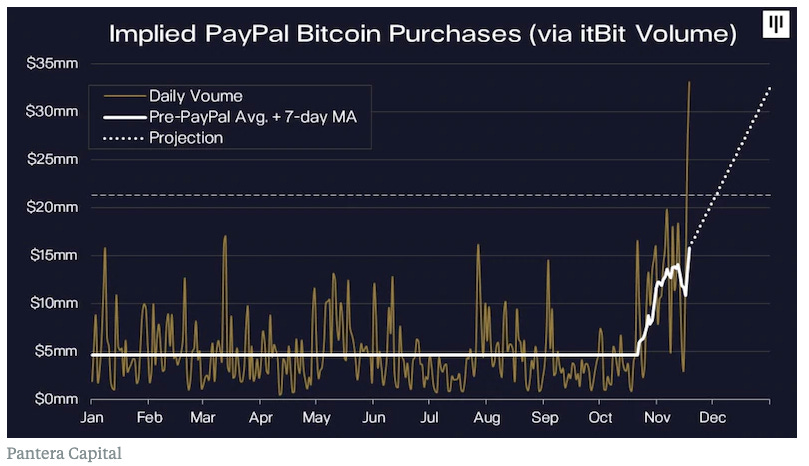

However, services like Paypal and Square are doing well per the below, and Robinhood has been crashing (presumably due to high demand). These are institutions themselves that may manage their own inventories during business hours. On a more general note, this also means that retail buying through these institutions may not necessarily show up in real time like it does on Coinbase and Binance.

#3 PayPal and Square's Cash App have scooped up 100% of newly mined bitcoins. According to Pantera, a chief reason for Bitcoin's rally is the ease of investing via PayPal, Cash App, and Robinhood. PayPal has already bought 70% of newly issued bitcoin, while Square is estimated to be buying about 40%.

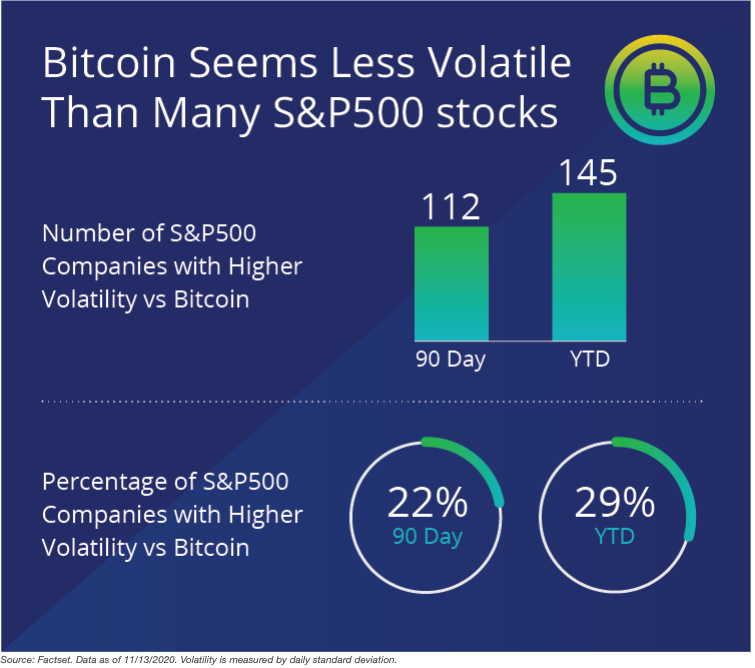

#4 VanEck study: “Bitcoin: Less Volatile Than Many S&P 500 Stocks?” A bullet to debunk any criticism people may throw at you at Thanksgiving dinner 😉

The Big Picture

#1 It’s not all about VC: Tech Startups Eye Debt Raises. But should they? Crunchbase writes there is rising interest in debt as founders and entrepreneurs look for ways to raise capital without diluting ownership. Debt often has been used by tech startups to pump up their balance sheets during late-stage financing, but now many are looking at it as a viable option much earlier. However, raising debt at earlier stages can be risky.

IMO, bringing tokens into the capital structure could be a solution here for growth stage companies with good momentum. In this model, a new product offering (or premium features) can be financed by early adopters that then benefit from any upside. These tokens don’t add leverage and aren’t dilutive either.

#2 A Stock Market Bubble? It’s More Like a Fire. Wild market speculation can feel like an out-of-control blaze: the more it expands and the hotter it gets, the more havoc it can wreak.

Three conditions “the fire triangle” have to be met for flames to erupt and persist:

The oxygen of investing is marketability, or the ease of buying and selling an asset. Nowadays, a stockbroker like Robinhood in your pocket;

Fuel is manifested in financial markets by money and credit. Low interest rates make investing with borrowed money cheaper, while paltry yields on safe savings compel people to invest in riskier alternatives;

Heat is supplied by speculation. When prices go up, more people buy, inflaming prices even more and attracting another rush of speculators.

A fourth element, the “spark”, coming from technology or government intervention is also needed. Most bubbles tend to be confined to a few stocks or industries. The bigger worry today is that a fire among a few giant [tech] stocks can set the neighborhood ablaze.

#3 Inflation isn’t increasing...yet. This is hardly surprising. Quoting from Paul Tudor Jones’ essay The Great Monetary Inflation: “It is reasonable to expect inflation to first fall in the coming months, given the large contraction in demand relative to supply. The issue is whether a large monetary overhang in the recovery phase will eventually stoke consumer price inflation.”

Quote of the week

Challenging the headlines

Being the skeptic here for a minute, Coindesk featured an article this week “Coinbase Has Raked in $14B in New Institutional Assets Since April”. According to Coindesk, Brett Tejpaul (a former banker) told interviewer Eliisabetta Bartolini, partner at Heidrick & Struggles, that institutional assets under custody were $6 billion when he joined the firm in April and have grown to $20 billion today.

I am happy to be proven wrong, but isn’t that the same time frame over which bitcoin increased from $6,623 (April 1) to around $19,000 today?! Doing a back of the envelope calculation taking out the price increase for that $6 billion, I get an increase of $2.7 billion. Still an impressive 45% increase in new assets but not exactly “raked in $14 billion in new assets”.