Introducing Thursday Threads

This is a new weekly feature. Curating content every day has helped me connect the dots which often generates (hopefully!) interesting insights. Thursday threads will share these with you. It is original content intended to provoke thought around the broader picture surrounding digital assets.

To make it easy for you, the weekly feature will also cover a brief summary of the top 3-5 stories and “food for thought” pieces in the last 7 days.

Looking forward to hearing your feedback!

Any views expressed are my own and do not represent the views of my employer.

In this issue

Why 2021 will be the inflection point for digital asset adoption

In case you missed it: summary of the top stories + “food for thought” top picks

Why 2021 will be the inflection point for digital asset adoption

TL;DR: Ever since the ICO boom the industry has been wondering when the institutional floodgates will open. In other words, when will crypto have its Netscape moment? I am seeing at least 9 signals converging into a compelling narrative that make me believe that crypto will cross the proverbial chasm in 2021. This essay will run you through my thinking.

Crypto as an asset class had a lot of momentum in 2017 on the back of the ICO boom. When I started working full time in crypto in 2018 everyone was still firmly believing that traditional institutions were about to enter the space. And although the signals were there, it didn’t materialize. As crypto headed into a winter and regulators remained quiet, firms put their plans on ice. Retail momentum meanwhile got a hit too, as many investors burned their fingers when most ICOs turned out to be empty promises. A host of tokens lost significant value as reality kicked in. In the end, there were few real, usable products out there.

Broader adoption is, obviously, key for crypto to reach its potential as an asset class. As crypto is community-centric, this means adoption both in terms of usage and investment, as the two are closely connected.

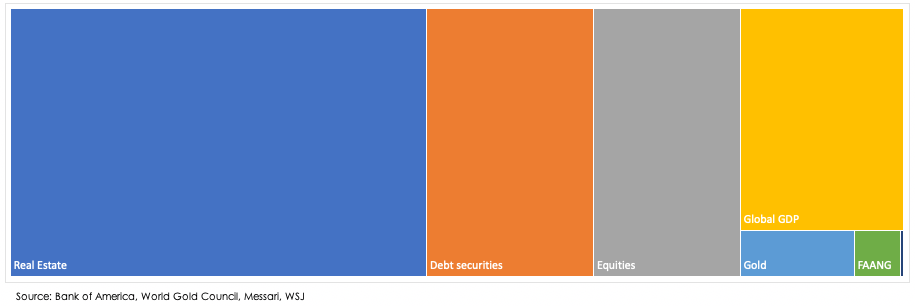

In a Global Macro Investor (GMI) report recently made available through Delphi Digital, Raoul Pal noted “Crypto is no longer a secret, but it trades as if it is.” He was referring to crypto’s overall market cap, currently around $325 billion, which is tiny compared to other asset classes. As reflected in the graphic below. Crypto is the tiny black stripe in the bottom right corner that doesn’t fit a label...

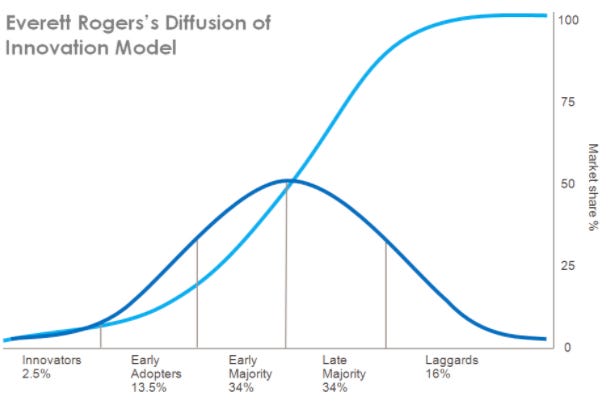

The shape of the technology life cycle is often referred to as an S-curve, representing its beginning, rapid growth, and maturity. The inflection point in the curve reflects usage by a critical mass. It is the point where the relative speed at which participants adopt an innovation increases exponentially. For the internet, this moment was the IPO of Netscape, also dubbed “Netscape moment”. The high visibility of the IPO signaled the dawn of a new industry. The million dollar question is, when will crypto have its Netscape moment?

The blockchain technology that forms the technological foundation for the asset class is widely considered transformational like the internet, electricity, and machine learning. And there is no longer any doubt in the minds of big institutions that crypto will be big. The question is when, not if.

In order to reach this point, a number of things need to come together to “cross the chasm” to mass adoption. I believe that this will happen for crypto in 2021. Curating crypto news and opinions on a daily basis for The Digital Asset has been a great way to stay on top of signals. Right now, I can see at least nine flashing signals that are converging into a very compelling narrative forming the basis for this belief.

#1 Unprecedented monetary intervention powering the Bitcoin narrative...

On the back of COVID-19 we are witnessing an unprecedented monetary expansion. This is expected to drive up inflation in the medium term.

Bitcoin falls in the “store of value” category, an asset that holds its purchasing power. It is the only large tradeable asset that has a known fixed maximum supply by design. In proponents' view, owning a small percentage of bitcoin in one’s portfolio is a great way to defend against inflation. Various research analyses have shown that a low single digit allocation to Bitcoin will increase the overall return of a portfolio for only a small increase in risk. Here is a recent study by ARKinvest and Coin Metrics (page 20-24).

This narrative has started to resonate with a broader audience in the last 6 months including institutional investors (see below).

Why does this matter?

Some facts from a recent Bank of America report:

$1.4bn: central bank asset purchases every hour since March lockdowns

1.7%: dividend yield on S&P500 now same as 5-year breakeven inflation rate

$14tn: value of global negatively yielding bonds

With equities and bonds forming the core of many large institutional portfolios, more institutions may soon be looking for yield enhancement to compensate for negatively yielding assets. And Bitcoin will be on their radar this time…

#2 ... has led to the embracement of crypto by high profile institutional investors

$75 billion hedge fund Renaissance Technologies (RenTec) said in a March-31 regulatory filing, that its famed Medallion Fund would be able to buy bitcoin futures on CME.

In a letter to investors in May, macro investor Paul Tudor Jones said he is buying Bitcoin. Jones views the investment as a hedge against the inflation he sees coming from central bank money-printing, which reminds him of the role gold played in the 1970s.

Meanwhile, CME’s regulated Bitcoin Futures market has seen heightened levels of volume and open interest throughout 2020 on the back of increasing institutional interest.

Grayscale, which manages a number of exchange traded crypto funds, has seen record inflows in 2020 with the majority coming from institutions, including many first time investors.

Pending more regulatory clarity and intermediary services by large incumbent financial institutions, CME and Grayscale offer institutions access through traditional channels while at the same time avoiding operational complexity.

Why does it matter?

Obviously, money flowing into Bitcoin is great. Demand will drive prices up which will increase its overall market cap and that of the asset class. In addition, once investors are in the ecosystem, they may look at other crypto assets too.

Mainstream media outlets reporting on bitcoin investment by well-known and respected institutional investors creates more visibility for the asset class.

Paul Tudor Jones and RenTec investing in crypto removes a degree of reputational risk that may have held back other portfolio managers.

Asset managers can no longer ignore the asset class and have the fiduciary responsibility to their investors to at least look at it and evaluate the opportunity.

#3 In addition, 2020 has seen endorsement for crypto assets from large institutions

JPMorgan started banking Gemini and Coinbase.

Mastercard and Visa are providing services to crypto companies.

Paypal is getting into crypto.

Fidelity launched a Bitcoin fund.

Why does this matter?

All of these reputable financial institutions are realizing the potential of crypto as an asset class and that they may be missing out on an opportunity to create substantial value for their shareholders.

#4 In fact, rumor has it that the OCC announcement was induced by a request from a large financial institution

On July 22, The Office of the Comptroller of the Currency (OCC), a leading US banking regulator, announced in an interpretive letter that national banks may provide custody services for cryptocurrencies. Although the announcement itself leaves a number of open questions, it is widely regarded as a positive development in the legitimization and progression of the industry.

The bigger news, however, is how it happened. A major national bank reportedly told the OCC it is considering offering crypto custody and asked for an opinion letter. The OCC would only do this for a very large bank.

Why does this matter?

A major bank with a large balance sheet offering crypto custody will remove a massive barrier to entry for large institutional investors. This could open the floodgates.

#5 Staying with regulators, Central Banks are realizing that the financial system needs an upgrade. Central Bank Digital Currency (CBDC) is one of the hottest themes this year

This has led to FOMO…and China wants to be first. An article published last weekend in China Finance, a magazine run by the People’s Bank of China (PBOC), said “China has many advantages and opportunities in issuing fiat digital currencies, so it should accelerate the pace to seize the first track.”

China has been working on this for six years and there are signs all over (including here, here, and here) that they are moving over to implementation soon. There is a real chance that this may happen in 2021.

Why does this matter?

CoinList said it well: “If billions of people will have digital wallets and possess a new understanding and familiarity with digital money, the onramp from there to a non-sovereign, global currency like Bitcoin becomes much shorter and faster. If every financial institution has to build out the tools and infrastructure to safely store and transact CBDC, that same infrastructure could potentially be used for Bitcoin.”

#6 Crypto investment strategies are knocking it out of the park in 2020

The Eurekahedge Crypto-Currency Hedge Fund Index was up 65.88% over the first 8 months of 2020. And Bloomberg reported yesterday “The Bloomberg Galaxy Crypto Index of digital coins is up about 66% in 2020, exceeding gold’s jump of more than 20% as well as returns from global stocks, bonds and commodities.”

Why does this matter?

Money talks. It has been tough for crypto-native funds to raise capital from true institutional investors (allocators like pension funds and endowments that can write large checks) since the crypto winter started in 2018. Stellar performance may change this. Obviously, this would mean more money flowing into the liquid crypto markets.

#7 DeFi and smaller coins with real use cases played a big part in that positive performance

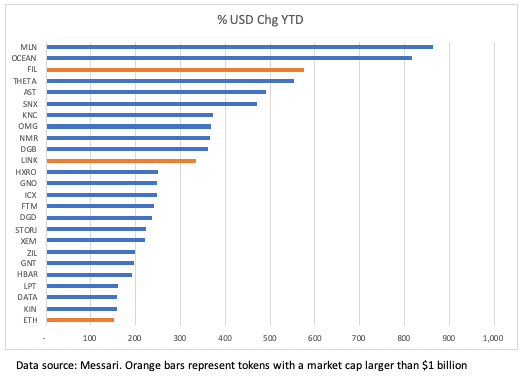

Using Messari data and a minimum market cap filter of $25 million, of the top 25 performers year-to-date, 22 have a market cap under $1 billion.

Bloomberg attributes the performance to a surge in Ethereum, which accounts for more than a third of its index’s weight. In turn, “increased adoption of decentralized finance, or DeFi, has driven the climb in Ethereum”.

Why does this matter?

Unlike the ICO boom of 2017, these are properly structured tokens with real use cases and actual users. DeFi is one, sports collectibles is another, and the NFT (non fungible token) theme is heating up as we speak.

In addition, a mobile version of MetaMask, a popular interface for dApps (decentralized Applications) has just become available through the Apple and Google app stores. MetaMask makes interacting with dApps a more user friendly experience. MetaMask is expecting to substantially increase its user base on the back of the app. Easier access will remove a barrier to adoption of dApps by a broader user base.

#8 Talent is flowing into the crypto space

Not a week goes by without headlines about people with impressive resumes moving into crypto. Not just on the project side but also in investment and the surrounding ecosystem. Just in the last couple of weeks:

Google, Venmo, Adobe Execs Join Coinbase Leadership Team.

Former HSBC, Citigroup, Merrill Lynch Execs Started a $50M Crypto Fund.

The Libra Association hired a former HSBC Europe CEO.

BlockFi Hired a public company CFO ahead of a potential IPO.

Coinbase hired a Lyft and Google alum to lead engineering team.

Why does this matter?

These are people that are leaving high paying jobs with a stable career path behind to help build out the crypto ecosystem. They have that much confidence that crypto will succeed, and that this is the right time to step in. Other people are reading these headlines too and may feel inclined to look into the asset class as a potential investment or career.

#9 Last but not least...IPOs. Coinbase’ rumored IPO in particular

Reuters brought an exclusive in June quoting sources that Coinbase is looking to go public in 2020 or early 2021 through a direct listing. Coinbase is currently valued at $8bn and is backed by prominent investors.

Crypto lender BlockFi, one of the hottest and fastest growing startups in the space, has indicated that a 2021 IPO is in the cards.

Digital financial services firm Diginex is planning a backdoor Nasdaq listing.

Why does this matter?

A public company has more visibility to the public than a private company. In addition, larger public companies will be covered by the research analysts of the big investment banks, in itself a step forward. All of this will make large financial institutions more familiar and comfortable with crypto as an asset class which may entice investment.

A Final note

Crypto market infrastructure has come a long way since I wrote “Crypto: Where Are The Institutions?” in mid 2019. Not a signal, but definitely barriers to entry removed.

A “true” prime broker (PB) is one missing piece. Coinbase, Fidelity, Genesis, and Galaxy, amongst others, have all launched PB offerings in 2020. Traditional institutional investors though, likely want to see a financial institution with a very large balance sheet entering the space. Further regulatory clarity is a key element holding this back. Perhaps next steps from the SEC, OCC in 2021?

Top Stories in the Last Week

Crypto exchange Kraken receives Wyoming bank charter

Kraken became the first crypto company to receive a bank charter.

It is making Kraken Financial the first regulated U.S. bank to provide deposit-taking, custody and fiduciary services for digital assets.

According to its CEO David Kinitsky, at launch, the firm will “be integrating banking and funding services for existing Kraken customers”.

Other products Kinitsky expects to offer in the future: digital asset lending and payment products (“like debit cards”), qualified custody for institutions, and wealth management investment services.

Ultimately, the bank hopes to “service other asset classes, including securities, commodities and derivatives”.

What’s all the fuss about Uniswap?

Uniswap is the #1 Decentralized Exchange (DEX) in terms of Total Value Locked (TVL) according to DeFi Pulse.

Its volumes in recent weeks rivaled that of centralized exchanges... “few seem to understand that Uniswap currently has the deepest ETH spot books in the world”.

Last Wednesday, Uniswap launched its UNI governance token and distributed 400 free tokens (an “airdrop”) to anyone who had used the protocol before.

Following the event, people started to question whether the token should have been registered with the SEC (see below).

UNI tokens debuted at $1.96, reached a high of $7.50 on Saturday, and then crashed down with the rest of DeFi and is currently trading around $4.85 (source: Messari)

Swift Shift from DeFi to NFT

As DeFi tanked this week following an action-packed summer, attention on crypto Twitter switched to Non Fungible Tokens (NFT) with a blink of the eye (it seemed anyway). Ari Paul of BlockTower Capital shared his view on the sector. Probably best to spend the minute to read it.

Crypto Is Beating Gold as 2020’s Top Asset So Far

The Bloomberg Galaxy Crypto Index is up ~66% YTD, outperforming gold, global equities, bonds and commodities. Gains in Ether, fueled by increased adoption of DeFi, was a key reason for the stellar performance. DeFi collateral levels have reached $9 billion from less than $700 million at the start of the year. Another reason why crypto markets have done well during Covid-19 was fueled by Bitcoin’s digital gold status.

Food for Thought: Top Picks

Your Next Bank Will Be a Tech Giant

The pandemic underscores the need to upgrade ancient global payments infrastructure to facilitate fast and low-cost payments.

Big tech has long realized that in a digital world, payments are at the core of every tech offering.

Tech giants are well positioned to deliver this with their huge loyal customer bases, massive distribution systems, and customer insight that is far superior to financial incumbents’.

Successful tech companies also have superior technological infrastructure that is no match for aging legacy systems that banks operate on.

Accenture predicts that by 2025 banks will lose out on $280 billion in payment revenue. To keep up, banks must modernize their infrastructure and turn to blockchain to facilitate ultra-fast and low cost payments, OR, start looking at strategic partnerships with technology companies.

Is Uniswap’s UNI token a security?

Preston Byrne expressed his views in a Coindesk OpEd

“Generalizing greatly, more often than not, a coin that airdrops or is pre-sold in vast quantities to US citizens is going to attract attention from US regulators and, as encountered in the wild, is likely to satisfy the Howey test”.

We know from the release of several no-action letters that not all tokens are securities. “But as a practical matter, many, if not most, of them will be”.

Courts work with economic reality, and economic reality on this airdrop looks a lot like an investment contract.

The fact that the SEC has done nothing about it right now is not a waiver of its enforcement powers.

Battle of the Dexes

BitMEX Research explores the seven year history of decentralized exchanges...

Analyzing why early attempts failed;

How these evolved into the Uniswap protocol;

Exploring Uniswap, its copycats, and its fit into the broader DeFi landscape;

Concluding “that most of the DeFi excitement is generated by unsustainable price bubbles and aggressive token issuance schedules, fueling speculative demand”;

However, “there could be something brilliant and sustainable, at least towards the lower layers of the DeFi pyramid” as “non-custodial, leveraged, quasi decentralized trading, is too compelling of a concept to ignore”.