As the sun is soon to set on 2020 for the last time (if it hasn’t already for you), a few reflections.

There are a lot of things that I am not good at, but my brain is pretty decent at making connections between things. I like comparing it to a radar that continuously scans the environment for information and then automatically starts connecting the dots. Annoying at times — it doesn't have an off switch — but generally speaking useful otherwise.

Doing the newsletter every day has been feeding that engine, which often leads to ideas and insights that I get excited about. Writing then clarifies this thinking. So, given that I had built an audience over the last two and a bit years with the newsletter (you!) I figured I'd start sharing some of these thoughts. And Thursday Threads was born. This then led to even more thoughts — too many to share 💥

Anyway, three points I would like to make here:

I am grateful to have you as an audience;

Given a general lack of news this week I decided to share a few random thoughts that I didn’t have a chance to share yet;

Nothing is random, things are a lot more connected than you think — don't be fooled by randomness!

Finally, the pic is the last sunrise of 2020, taken from my local mountain this morning. I think it is fair to say we are all happy to close this one off. Wishing y'all a fabulous 2021 — may all your dreams come true and bitcoin continue to fly 🚀

In todays issue:

INX term sheet

Why smart finance people don’t get bitcoin

What do you do with NFT digital art?

Security tokens: what's (not) in a name?

Options 101

Why is Fireblocks not on this list?

Capital efficiency: a double edged sword

Goldman Sachs will have unique insight into crypto

What’s up with Bakkt?

Bitcoin will be the new buzz word on earnings calls in 2021

Random Thoughts

INX term sheet

INX did a SEC-registered offering in August, the first of its kind. I read the prospectus and the purchase agreement and there are a few things that jumped out to me about the structuring of the offering (not to be confused with the structure of the token itself). The offering structure is relevant as it was approved by the SEC and can be used as a precedent for future token offerings. I expect that 2021 will see more of those including from more established companies.

Purchase Agreement

A purchase agreement is typically signed with the underwriter of a public securities offering, or, in the case of a private deal with investors directly. How they structured it here is that investors go to a web portal designed by TokenSoft for “onboarding”. Upon passing of KYC/AML and other requirements, initial investors can review the purchase agreement to which they become a party directly upon purchase.

Ongoing compliance

In addition to KYC/AML at launch, token transactions will be vetted on an ongoing basis through a “Whitelist Database”. Buyer and seller have to be listed in this database stored in the smart contract or else the transaction will be rejected.

Fees

Outside of the US, INX used A-Labs as an advisor and selling agent. They got paid very properly. The fee has a fixed and a variable portion and the latter is subject to accelerators that kick in once certain amounts of tokens are sold. Let’s put it this way, A-Labs is very incentivized to sell these tokens, and comp is well in-line with traditional IPO fees if not higher 🤑

Lockup

There is a lock-up of 2 years for officers, directors and holders of 5% or more. This is good market practice. It also seems long enough to reduce any immediate overhang once the project starts delivering product and be traded more actively. Typical IPOs have a 180 day lock-up.

In general, it seems like a properly structured offering that can serve as a blueprint for future registered token offerings, i.e. someone else did the hard work. The way these things typically work is that a prospectus of a precedent offering is used as a template.

Why smart finance people don’t get bitcoin

I have been fascinated by the number of smart finance people that don’t get bitcoin (and crypto in general, but bitcoin will be the starting point for most). In my opinion, one of the key reasons why these people don’t understand bitcoin is that they reason by analogy rather than first principles.

First principles thinking is the act of boiling a process down to the fundamental parts that you know are true and reasoning back up from there. Most groundbreaking ideas have been a result of boiling things down to first principles and then substituting a more effective solution for one of the key parts. Finance people should apply this same method when looking at a revolutionary concept like bitcoin.

Let’s briefly illustrate this by exploring two angles that are of equal importance in understanding bitcoin as a finance person.

Intrinsic value

One of the reasons for rejecting bitcoin is that “it doesn’t have intrinsic value”. Typical investment portfolios have equity and debt at their core, where you discount cash flows. As bitcoin doesn’t generate cash flows, people don’t get it.

The analogy. Finance people rarely think outside (1) the silo of “their” asset class/product, and (2) the context of established valuation models.

First principles. Some of the basic questions to ask here are: What is an asset? What gives something value? Why do we invest in the first place?

Reasoning back up. In order to develop a perspective on valuation, they should both go back to first principles and take cue from asset classes beyond their silos. This should then be combined with a better handle on the technology to make an assessment of what contributes to value. Next appropriate valuation methods can be established.

The technology

As we all know, in order to understand digital assets, it is key to understand blockchain technology. I am not talking about Bob and Alice here. They are actually part of the problem. We are at a level now where people don’t need to understand the nitty gritty of what is under the hood anymore. That may in fact be where many give up and make excuses.

First principles. Instead, we need to better explain the concepts and technology underlying bitcoin from first principles, in simple and concise terms. Starting with what they are likely to agree with.

Basics like:

What is the internet, really, and who owns it (trick question)?

What is decentralization, a network, a protocol? What is code?

What is trust? What is trust in economic transactions?

What is ownership? How do we enforce ownership rights? What is a ledger?

I tell you, people never think about these things because they don’t have to.

Reasoning back up. From there, people have a solid basis to get their heads around more abstract concepts like how something digital can have value. It will help them look at things like decentralization and how this is achieved in public blockchains through a better lens.

People don’t “buy” something they don’t understand. This is not new, take specialized sectors like healthcare, take internet stocks in 1999. Aswath Damodaran published a whole book about the latter in 2001.

I think there is a real opportunity here.

What do you do with NFT digital art?

NFTs have been the talk of the town in the fall. Sub-sectors like NFTs representing collectibles and art seem to be rapidly growing. I have come across a number of good pieces on this but none of them addressed the very basic questions of what the heck you do with it! I went on a mission to find out. Here are two takes.

#1 Collectors are still experimenting, but many use digital frames. Others project it on a tablet or TV. And an increasing number of people are showing off their new purchases in open, ownership-based VR worlds like Decentraland. “It may be niche, but there seems to be an interconnected virtual economy growing in these online spaces”.

#2 According to Piers Kicks at Delphi Digital the value of digital art often comes from social signaling. Projects like Flawnt allow users to organize their NFTs into galleries to show off their NFTs to their buddies. Piers compared it to Instagram, but then one where you own your creations.

I am fascinated.

Security tokens: what's (not) in a name?

“Security token” is one of the most abused and confusing (and annoying) terms in crypto. There is no such thing as a security token. A token is either a security or it is not ✌️

Options 101

Binance announced European-style options this week. I find it interesting how badly written some of these explanations are (Binance is not alone here) for something as risky as options for retail.

These two statements are particularly interesting and confusing:

#1 "Binance said American-style options' ability to be executed at any time often results in a higher premium, while European-style options' pricing can be lower in comparison."

Apart from situations where there are issues with borrow, this is only true for put options in the case of bitcoin. An American call and a European call with identical parameters on an asset that does not pay income should have the same value.

#2 "Users can both buy the options for hedging and trading, as well as write and sell options as an issuer. Binance’s American-style options do not allow users to write the options themselves."

This is confusing and makes it sound like it is a bilateral contract, which it is not, as all exchange-traded contracts are by default standard and fungible. The buyer of an option is called the holder (long position) and the seller the writer (short position).

Why is Fireblocks not on this list?

10 Crypto Companies That Made a Big Splash in 2020

I have seen a number of similar lists and have been surprised not to see Fireblocks on any of them.

Fireblocks is one of the fastest growing companies in the space by a number of measures including volume transferred, number of clients, and people employed;

Fireblocks pioneered a solution to a real problem for institutions entering the space and brought it to market very successfully;

Anecdotally, I hear their name very often in the context of traditional institutions looking at the space. In my mind a reflection of quality and future growth prospects.

My two cents!

Capital efficiency: a double edged sword

We discussed capital efficiency a couple of times. I had been thinking about it mainly as a problem for the space. However, on reflection, we also spoke about it in the context of lending. In particular, how the shortage of capital in the space allows certain arbitrage opportunities like the carry trade to persist. This in turn has fueled the lending boom.

The above kind of makes capital efficiency a double-edged sword for crypto?

Goldman Sachs will have unique insight into crypto

Coinbase reportedly mandated Goldman to lead its upcoming IPO.

As part of the IPO process, bankers will conduct due diligence. The purpose of due diligence is (1) to put together the required information for the registration statement, (2) verify that no material information is omitted, and (3) make sure the disclosed information is accurate. In addition, bankers will need to understand what they are selling once the roadshow and bookbuilding start. As part of the due diligence process bankers have access to comprehensive financial and business information. They also get to interview management and external stakeholders.

With banks expected to enter the crypto stage in 2021 this comes at an opportune time for Goldman. It will give the bank unique insight into market dynamics, participants, their behavior, and running a crypto trading business in general.

It will also force bankers to take a deep dive into crypto which may unlock token-powered capital markets innovation.

What’s up with Bakkt?

With a $300M Series B, Bakkt is part of Crunchbase’ top 50 of companies that raised the most funding in 2020. It is the only crypto company on the list.

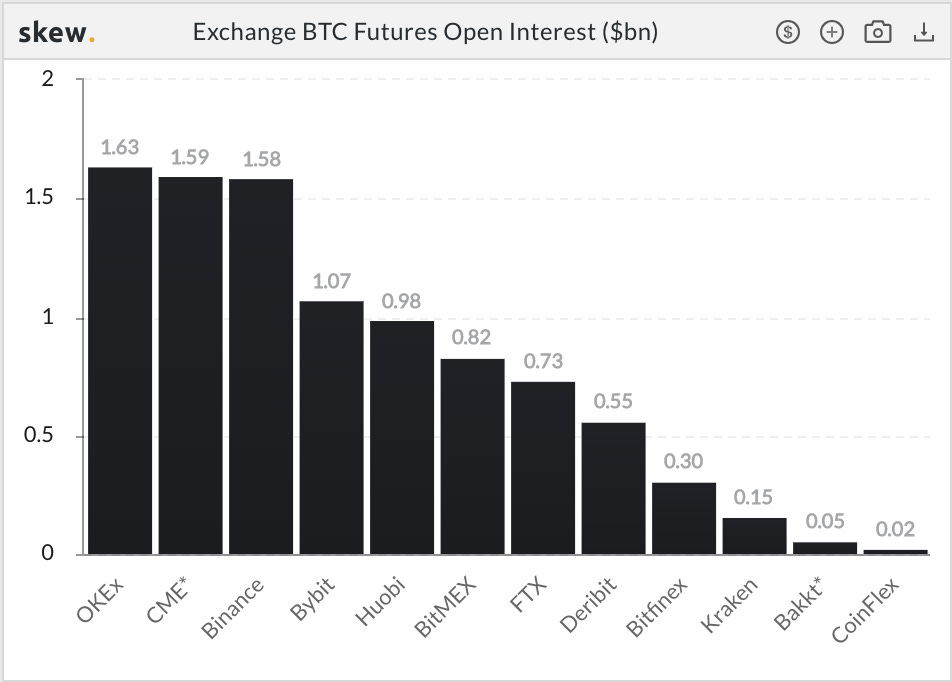

For all the buzz that Bakkt generated at launch in the summer of 2018, the company hasn’t been in the news much. CEO Kelly Loeffler left for the Georgia senate at the beginning of the year and the company announced a partnership for Galaxy’s prime brokerage in June. Otherwise, Bakkt’s exchange barely registers on skew’s tracker of open interest for bitcoin futures (below).

However, Bakkt is much more than a custodian and exchange. Business Insider recently reported that the company is rolling out an app where customers can track all of their digital assets, from loyalty points to gift cards, in one place. Bakkt's app will allow users to exchange rewards and loyalty points for one another or for cash, bringing a new level of convertibility to the market. It has already partnered with points programs at American Express, Chase, Chipotle, and JetBlue, among others.

This is really cool and shows the power of cryptographic tokens. It also makes me think of what we have discussed about tokens being used by corporates as a way to raise funds from customers. Combine this with JPMorgan already advising companies to use loyalty points for fundraising, and Goldman advising Coinbase and I can see this not being too far off. Especially now that we have established above (INX) that token-related funding can pay fees similar to traditional offerings...

Dare to dream!

Bitcoin will be the new buzz word on earnings calls in 2021

Remember the time when corporates used the word blockchain in press releases and earnings calls and their stock would rally? I wonder if a similar trend is developing around bitcoin and corporate treasuries.

In the news this week:

Greenpro Capital skyrockets +101% PM with announcement of bitcoin fund

Michael Saylor of the North? Canadian firm NexTech AR uses $2M of treasury funds to buy bitcoin.

Elsewhere, crypto-related stocks have been knocking it out of the park too: crypto-linked stocks extend rally that produced 400% gains.

On my radar!

Quote of the week

“I was wrong on Google and Amazon”

Warren Buffett in 2018

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.